Our Business

ACULYS is addressing the drug lag and the tackling social issues on behalf of patients. The following describes the social challenges that ACULYS addresses and features of ACULYS’s business.

Corporate Purpose

Resolving social issues associated with

neuroscience diseases

ACULYS’s corporate purpose is to serve as a catalyst for patient access to innovative medical means in the neurology area and deliver better medicine to patients, their families, workers in healthcare, and the society. We work toward resolving unmet medical needs by delivering to the Japanese market innovative medicines approved outside of Japan.

Social challenges that ACULYS is addressing

Drug lag, faced by patients

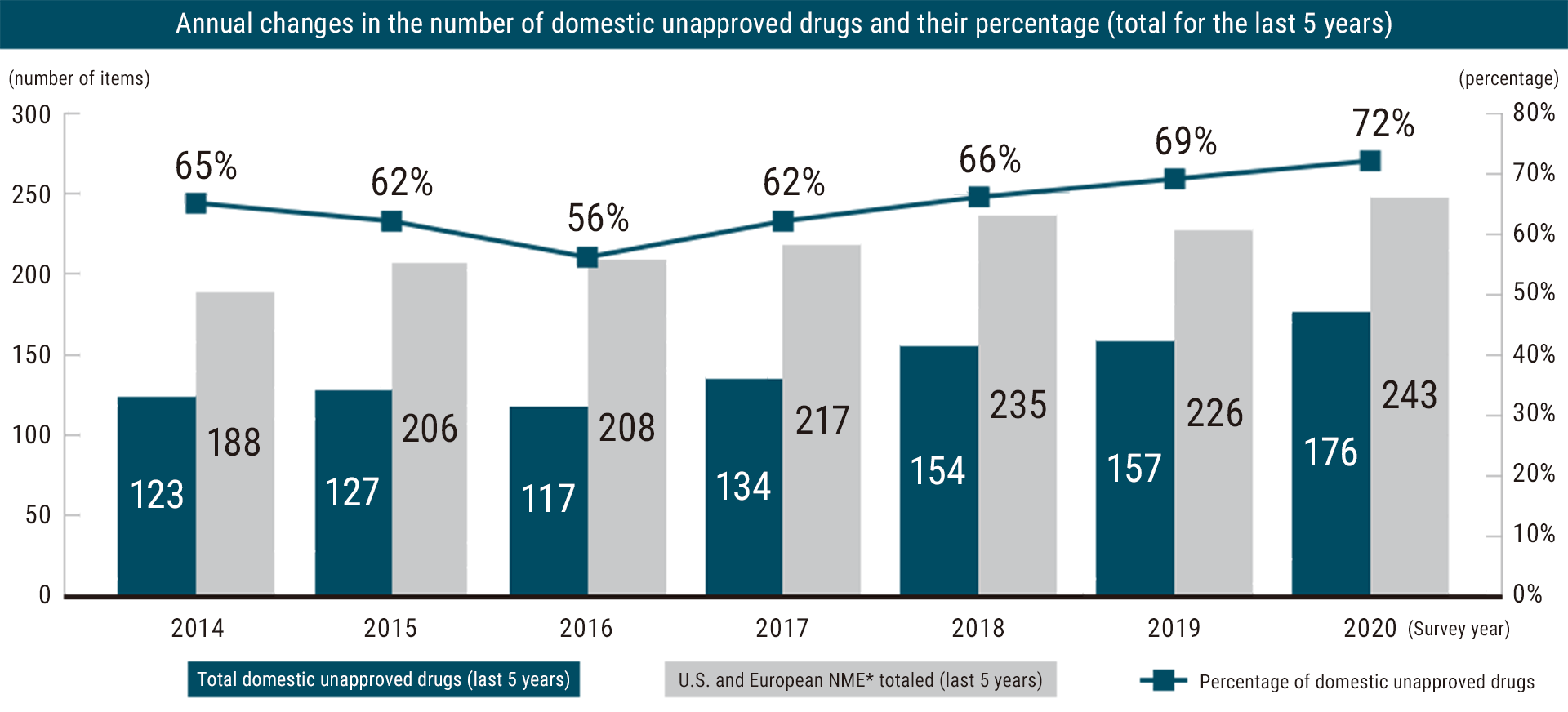

Due to Japan's unique regulatory requirements and approval processes, it can take significantly longer for new drugs to receive approval and become available for use in Japan than in other countries. This delay can be a significant challenge for patients and their families, who may not have access to the latest and most effective treatments for their condition. This gap has been increasing from 2016.

According to a study on new drugs containing new active ingredients approvals in Japan and EU/US, as of 2020, 72% of pharmaceuticals approved in EU and the US in the last five years remain unapproved in Japan, totaling 176 treatments*. This delay can be a significant challenge for patients and their families, who may not have access to the latest and most effective treatments.

* Article on drug lag highlighting domestic unapproved drugs and their characteristics; Office of Pharmaceutical Industry Research News No.63 (July 2021 issue); Office of Pharmaceutical Industry Research

Drug loss, from the underdevelopment of new drugs in Japan

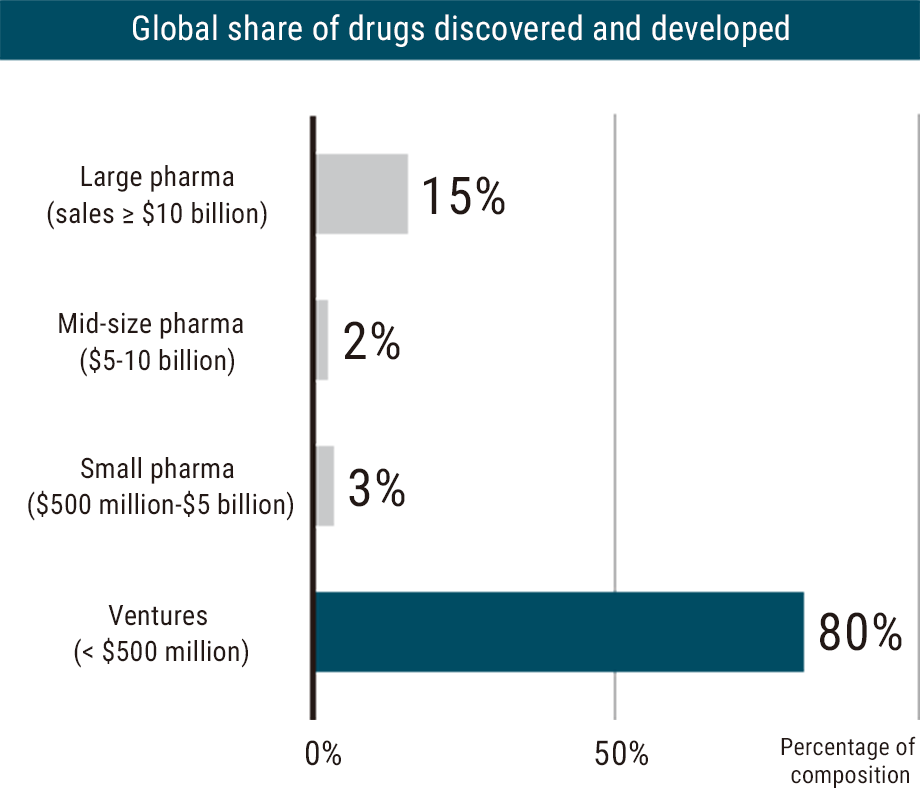

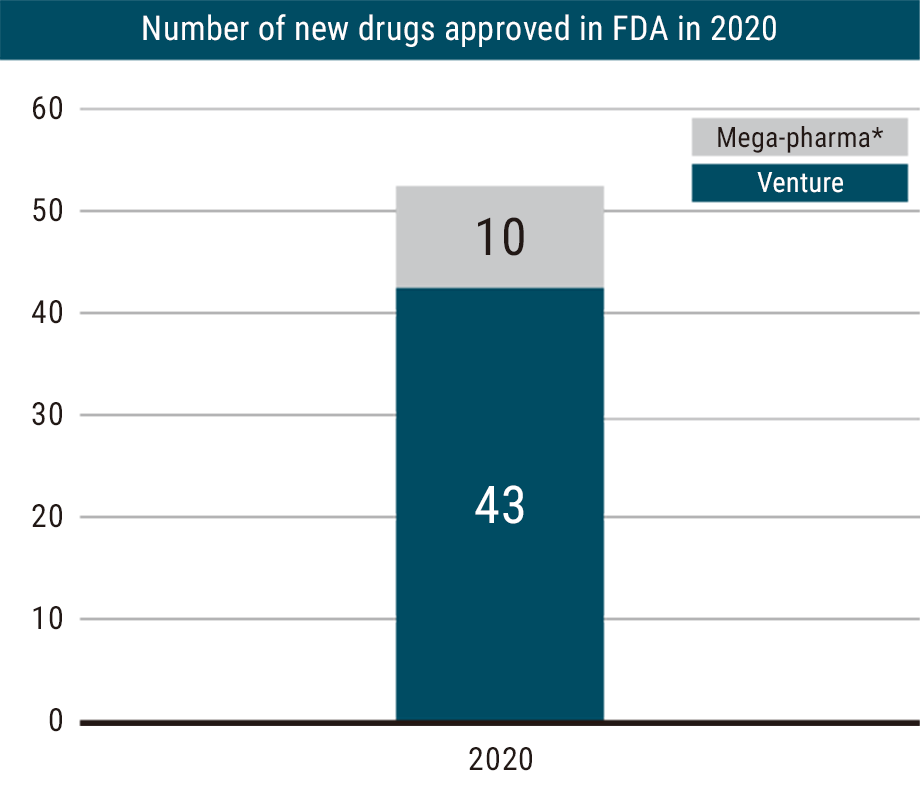

Around the world, startup companies play an increasingly important role in the development of new drugs, responsible for discovering and developing approximately 80% of new pharmaceuticals worldwide1). In fact, in 2020, venture companies and small to medium-sized companies generated 43 of the 53 pharmaceuticals approved by the FDA.2)

Despite these advancements, many venture companies and small to medium sized companies with limited funding do not take their innovations through the Japanese regulatory process, resulting in “Drug loss” In other words, even if the drugs have been approved in other markets such as the U.S. or the EU, they are not available to patients in Japan.

1) Chairman’s press conference material ( https://www.jpma.or.jp/news_room/release/news2022/gbkspa0000000zkk-att/220830.pdf ) ; August 30, 2022; Japan Pharmaceutical Manufacturers Association

2) ARC WATCHING March 2021 (https://arc.asahi-kasei.co.jp/member/watching/pdf/w_317-02.pdf)

Source: Chairman’s press conference material (https://www.jpma.or.jp/news_room/release/news2022/gbkspa0000000zkk-att/220830.pdf) ; August 30, 2022; Japan Pharmaceutical Manufacturers Association

Source: ARC WATCHING March 2021 (https://arc.asahi-kasei.co.jp/member/watching/pdf/w_317-02.pdf)

*Megapharma: Top 20 companies based on global sales

Neurology: An Area of Significant Unmet Medical Needs in Japan

In Neurology, the number of pharmaceuticals approved in EU/US but not in Japan has doubled from 11 items in 2016 to 22 items in 2020.1),and the gap continues to grow. Patient satisfaction and drug efficacy scores remain low2), highlighting further unmet medical needs.

Challenges in the disease area include not only a limitation in treatment options but also a broad range of issues that need to be resolved from a socioeconomic perspective, such as the adverse effects on patients’ social lives due to delayed diagnoses and the burden on family members or caregivers.

1) Article on drug lag highlighting whether drugs unapproved in Japan can satisfy unmet medical needs; Office of Pharmaceutical Industry Research News No.66 (July 2022 issue); Office of Pharmaceutical Industry Research

2) 2021 Report on study of domestic base technology (https://u-lab.my-pharm.ac.jp/~soc-pharm/achievements/img/index/r03.pdf); Social Pharmacy, Meiji Pharmaceutical University, and Office of Pharmaceutical Industry Research, Japan Pharmaceutical Manufacturers Association

Pipelines

We are currently building a pipeline of three indications in the field of neuroscience diseases.

In order to meet the unmet needs of Japanese patients as quickly as possible, we have begun development of drugs that have already been approved for use overseas but not yet approved in Japan.

code

Category

phase

code

with obstructive sleep apnea syndrome

Category

phase

code

spray

Category

phase